We’re not in a Mood

We’re not in the same mood, at least.

The polarisation that we’ve noted between regions, genders, generations and income bands has become well-established and remains as wide as the Humber Estuary. That means that there is no common experience and there is no single national mood. We are not all in this together. All of which makes marketing a bit more tricky.

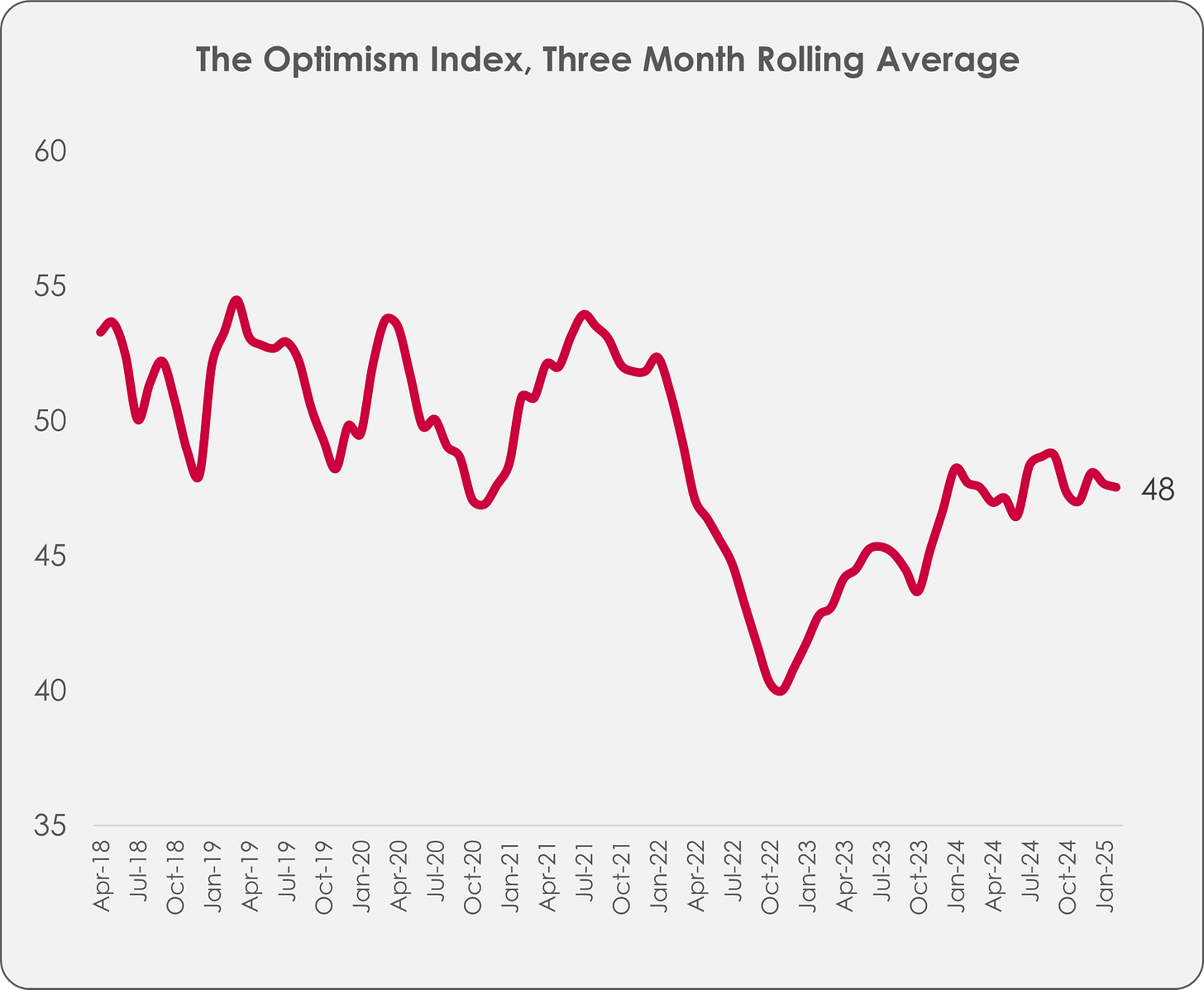

The headline, single month, measure of optimism shuffled upwards by a single point in February when compared to the previous month. Versus February 2024, optimism is unchanged.

Compared to this time last year, consumers expect to spend a bit more on enjoying themselves out of the home. While the cost of living is still high, there is enough stability to encourage the odd mildly indulgent visit to the Hungry Horse. Out of home leisure is a bellwether for consumer confidence as it’s purely discretionary.

More broadly, the tentative confidence that we’ve observed in household finances is reflected in the ONS retail sales figures for January (up by 2.6%).

Consumers are much more positive about their own finances than they are about the national economy. There’s now a delta of 19 points between the two.

The full detail from our Optimism Index monthly survey is available to our growing ranks of subscribers.

Anger Management

You might think that people seem angrier now than they were in the past. That’s because they are.

Gallup’s Global Emotions report quantifies the growing rage while the British Association of Anger Management report an accelerating number of enquiries.

While a bit of anger can be useful in some situations - Scotland’s rugby players could arguably do with more of it in the second half - it’s generally unhelpful. Some manifestations of anger impact directly on brands not least in customer service where those on the front line face increasingly volatile customers.

When times are tough, ethical concerns narrow as altruism is just that little bit harder to afford. The normalisation of shoplifting and increasing embrace of protest – often as a preferred alternative to traditional charities – is an example of consumer anger in action.

Anger is the subject of our next webinar. Our analysis will be informed by new research that we are putting in the field now. We’ll be focusing on the implications for brands. Strategists, policymakers and communicators will all find value in the session.

The webinar will kick off on March 27th at 09:00 and you can find more details and a registration link by punching the button. Hard. Like you mean it. Go on. It deserves it.

Reich Anxiety

Every month I look at examples of brands and businesses responding to macro-trends.

Along with 130,000 other people, I attended the Goodwood Revival last September. This is a sepia-tinged celebration of classic cars and historic motor racing, hosted by the clubbable and commercially-astute Duke Of Richmond. As I arrived, I parked next to an Alfa Romeo which was piloted by a fellow in his sixties. He was clad in appropriate period attire and to be honest he seemed pretty comfortable in his tweeds. I think he gets quite a lot of wear from that outfit. The conviviality of the Revival is such that he overcame his English reserve and we had a chat. He told me that he had recently considered trading in the Alfa Romeo for a Tesla. I was incredulous but remained outwardly calm. Encouraged by my equanimity (Goodwood isn’t a natural environment for electric cars) he went onto confide that he was all set to buy a Tesla until he realised that; “Elon Musk is a complete w*nker.” I was somewhat taken aback by this mild-mannered and well-spoken English gentleman using the language of the docks to express his feelings. Still waters run deep.

The Goodwood encounter made me wonder if other people might feel the same way as my flat-capped new friend.

Is there is now a malodorous and consumer-repelling musk secreted on Tesla products?

Plot spoiler: yes.

Last month, the Financial Times reported that annual Tesla sales to January 2025 fell by 63% in France, 44% in Sweden, 38% in Norway and 8% in the UK. Wired magazine reported a 75% drop in sales in Spain. In Australia, in January 2025, Tesla sold 33% less cars than in January 2024 despite deep discounting.

We need to be a wee bit careful here. There are some commercial reasons why Tesla sales have dropped off a bit – there is greater competition from cheaper and increasingly credible Chinese brands and the Tesla Model X and Model S now look elderly compared to rival BEVs. In addition, some consumers will have been waiting for the revamped Model Y which went on sale in the last couple of weeks.

However, should there be a whiff of doubt that there is an off-putting Musk, here is evidence that some people see Teslas as plug-in panzers:

The fall in Tesla sales is too abrupt and too severe to be entirely attributed to greater competition or an ageing range. The steepest declines have come in recent months as the NASDAQ observes: “When comparing sales from January 2024 to 2025, the 2025 sales decreased in the UK, France, the Netherlands, Norway, Spain, Sweden, Denmark and Portugal. The least significant decrease of all these countries was the UK, where sales decreased by 18%. The average decrease in sales between all of the countries listed was 47%.” Sales are also down in Democrat-voting California.

True, Tesla sales in the UK jumped 21% in February according to the SMMT. However, the BEV sector as a whole jumped by 41% last month due to an impending change in Vehicle Excise Duty (Expensive Car Supplement or ECS). From April, BEV’s with a value of £40,000 or more will be liable for ECS. In the UK, Tesla prices start at £39,990.

Last week, the Financial Times noted that Tesla stock peaked at $480 a share just after the presidential election and at the time of Mr Musk’s elevation to government. Today they are valued at $263.

Some owners are now wary of being associated Mr Musk through owning a Tesla and are buying stickers which declare; “I bought this before we knew Elon was crazy.” Amazon in the UK offer at least twelve variants of the sticker.

Corporations also fear reputational damage through owning Teslas – in Germany the energy company, LichtBlick, disposed of their Tesla fleet. Their Head of Real Estate commented; “Elon Musk’s support of Donald Trump and his recommendation to vote for a right-wing populist and right-wing extremist party … is in no way compatible with LichtBlick’s values.” The pharmacy chain, Rossmann, has also offloaded their Teslas.

In Germany, Tesla sales fell by 59% in January 2025 when compared to the same month the previous year. Tesla’s only European factory is in Berlin – so a decline in Tesla sales is potentially bad news for the local economy. The new German premier, Friedrich Merz, has criticised Mr Musk for hosting Alice Weidel, leader of the far-right AfD party, on his social media platform.

It’s hard to think of a more livid example of our Political Brands trend than Tesla. In our summary of the trend we state that; “Differences between cultures and societal norms will bring difficulty for international brands.” The dynamic in the Tesla story is interesting as it has forced other brands – such as LichtBlick and Rossmann – to respond and to take a stand.

There’s an irony in the fact that this protectionist American administration now faces a boycott on one of its stock market stars and leading foreign currency earners, not from other governments, but from consumers.

Subscribe to Trajectory

The world has become a more volatile place (just ask Olaf Scholz). For that reason, it’s vital to have an up-to-date understanding of what matters to consumers. Our monthly programme of quantitative research informs our subscription service and gives you a contemporaneous and reliable analysis of the consumer mood.

An annual subscription starts at the same price as a Tesla Model S car cover. You know what I’m saying. I won’t labour the point.

Here are the options:

Now

An offline service that continually monitors the consumer pulse. Subscribers receive a monthly report, invitations to subscriber-only webinars and an analysis of consumer sentiment based upon our monthly fieldwork. £500 per year, per user.

Now & Next

The core, online, package. Access to monthly data, webinars, reports, articles and macro-trends. £3,200 per year per organisation (unlimited users).

Now & Next +

All of Now & Next plus offline humanity! We’re including analyst support in this package. There is also the ability to add your own questions to our monthly fieldwork with 1,500 nationally representative Britons. £7,500 per year per organisation (unlimited users).