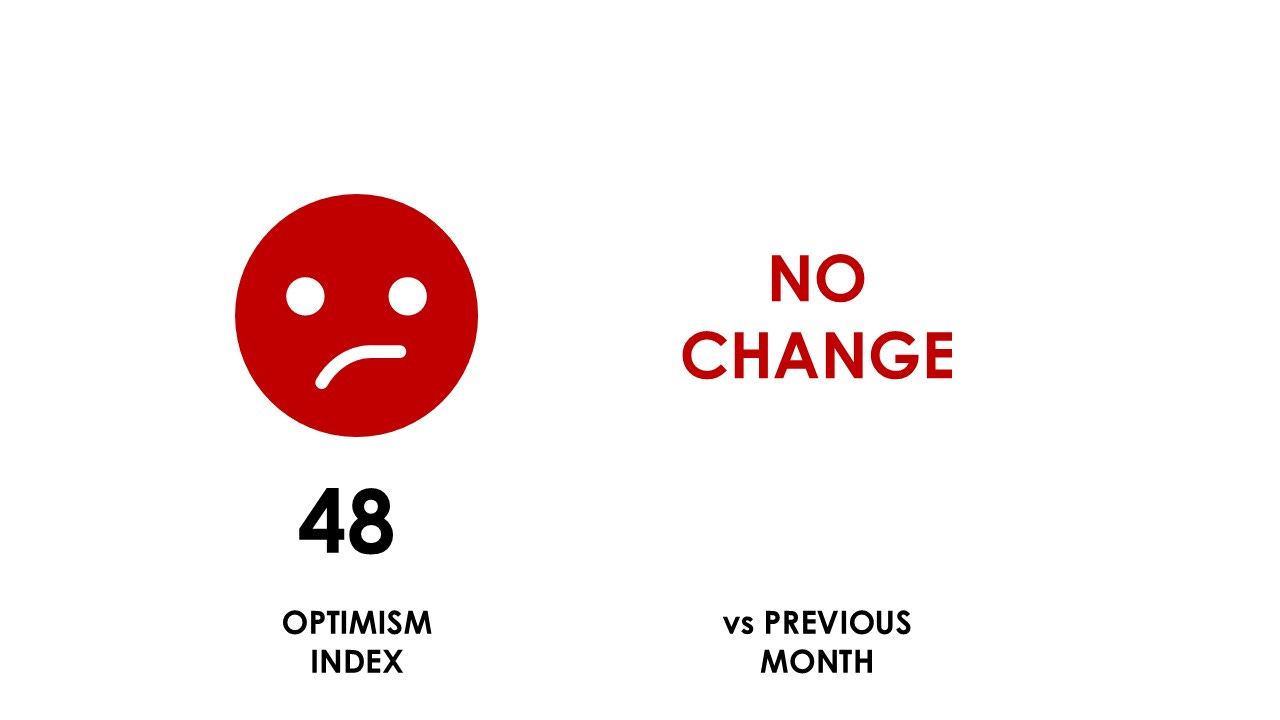

Steady

With the solitary exception of July, consumers have felt much the same throughout 2024. The British consumer-citizen has been in a remarkably consistent frame of mind all year - just shy of being optimistic.

As usual the interest lies in the detail. Net confidence in the national economy climbed in November (our fieldwork began six days after the budget). That might be the result of the government’s management of expectations through the summer and autumn. Confidence in the national economy has climbed nine points since September.

Overall, trust in politicians climbed in November by seven points.

Consumers have also become more confident about household finances in the last couple of months. However, spending expectations for December remain muted. There’s a wariness about reaching for the debit card this month and consequently Santa may not be as good to you this year.

The index continues to show a growing polarisation in levels of optimism between genders, generations, income bands and regions; men are more optimistic than women, the young are more optimistic than older people and the wealthiest (£83k+) are vastly more optimistic than anyone else.

In terms of consumer priorities, the NHS and the cost of living remain paramount.

As ever, the full detail of the Optimism Index is available to subscribers.

All About the People

Every month I’m looking at examples of trends in action.

Photo: A sighting of the increasingly rare European ankle-biting cost centre.

Demographic change sometimes seems wearily familiar. However, the importance of changing population structures is hard to understate. Some recent data from Eurostat and the ONS suggests that the pace of change is accelerating.

In 2023, the birthrate in the EU declined by 5.5% - the largest fall ever recorded. Across the 27 member states, the number of births slumped to 3.7 million, the lowest number since data was first collected in 1961. By way of comparison, six and a half million children were born each year in Europe in the mid-1960s.

Last month, the ONS released data showing that the fertility rate per woman in the UK has fallen to 1.4 - the lowest since records began and well below the level required for the UK population to maintain its current size (the ‘replacement fertility’ rate is 2.1).

Some see this change as a positive development - less people means less demand on the Earth’s resources. Others fear the practical and fiscal consequences of a proportionately larger group of elderly people. In some countries the balance between generations is truly sobering; when La Dolce Vita began to animate Italy in the 1950s, there were 17 people aged under ten for every person aged over eighty. The ratio now is about one-to-one.

La Dolce Vita seemed to pass the UK by in the 1950s (possibly because we couldn't see the 1950s until the Clean Air Act was introduced in 1956). In that decade, Britain had five workers for every retiree. There are now three workers per retiree. By the end of the century the forecast is 1.7 workers per retiree. That level is unsustainable and will force significant changes in how we live.

One solution might be to encourage younger people to do what (used to) come naturally. The Hungarians spend 5% of GDP on pro-natal policies to encourage the arrival of more Hungarians. As a consequence, the fertility rate has climbed from 1.25 to 1.5 - still well below the replacement rate. Governments can achieve many things but it seems that creating more people is beyond them.

The British government’s current struggle to reconcile a tax burden that voters and businesses will tolerate with the adequate resourcing of old age will become an ever-greater challenge. The tax burden can only increase from here.

Vested Interest

Photo: Paul Flatters faces the cameras after leading the discussion at the Vested ‘Disrupt or be Disrupted’ breakfast meeting last month.

Vested, the financial PR specialists, ran a breakfast meeting last month on the subject of what we might expect from 2025. Paul Flatters, Trajectory’s CEO, led the discussion, drawing on some material that will be shared at our annual look at the year ahead on January 30th 2025. (We’ll be posting more details on that trend briefing on LinkedIn shortly.)

Guests included senior representatives from a wide range of organisations including Lloyds Banking Group, HSBC, Barclays, Handelsbanken and OSB.

As you can see, Paul was interviewed afterwards. The suggestion that this was a screentest for a presenting opportunity on a popular competitive cookery show on BBC1 is just speculation.

Cross our Palm with Silver

Last month Tom Johnson and Patrick Brennan of Trajectory co-presented a paper on Millennials at the Media Research Group conference at the Barbican. While many in the marketing community remain beguiled by Generation Z, Tom and Patrick gently reminded the audience that Millennials are about to become the largest cohort in the UK. The centre of gravity has shifted and Millennials are increasingly influential. That growing size has consequences - Millennials largely voted for Labour this year and, for the first time, they got the party they wanted.

Delegates voted the Trajectory presentation as their second favourite of the day.

The presentation was an updated and enhanced version of our July webinar. Subscribers can access a recording of that webinar and the slides from our website.

In the New Year

Our January 30th webinar will preview the next twelve months but, in the meantime, there are some events taking place in 2025 that you might want to mark on your Sasco wallplanner:

From April, all non-visa visitors to the United Kingdom will be required to apply for Electronic Travel Authorisation (ETA) before visiting. Johnny Foreigner will be obliged to pay £10 to get into the country. Visitors arriving at London Luton Airport might think that’s a bit steep but it’s still £19 cheaper than an adult single admission ticket to Woburn Safari Park.

In the summer of next year, the Russian government plans to introduce a digital ruble; a government-backed cryptocurrency. Trajectory is not in the business of issuing investment advice but we note that actual ruble has declined in value by 15% against the US dollar this year.

From October 2025, fast food advertising on television becomes post-watershed entertainment. Before 9pm, you will no longer be confronted by graphic images of burger patties garnished with a token lettuce leaf and french fries tumbling through the air in slow motion.

Staying with health, single-use, disposable, vapes will be banned from June 2025. That means there will be less chance of your view of Oasis being obscured by smoke when their reunion tour starts in July (assuming that the most volatile fraternal relationship since Cain and Abel holds together for another eight months). Trajectory has worked with many financial services providers and we are therefore heartened to see a couple of blokes in their 50s making adequate provision for their retirement.

The suggestion that Hollywood is out of ideas is refuted by next year’s new releases; Zootropolis 2 (November), Avatar 3 (December), Scream 7 (February), Mission Impossible 8 (May), Jurassic World Rebirth (July), Superman (July) and Captain America: Brave New World (February).

Bradford will be crowned UK City of Culture in 2025.

The Women’s Rugby World Cup will take place in Britain and will welcome visitors from across the globe (as long as they’ve coughed up £10 each for a valid Electronic Travel Authorisation).

Tesla’s long-promised cheaper car (c. £20k) - the Model 2 - may arrive in 2025. It’s been promised before, so don’t trade in the Kia just yet.

Bradley Walsh is going on tour in 2025 with Brian Conley and Shane Richie; “with their own special take on the Rat Pack.” Book early to ensure disappointment.

We will continue to monitor, analyse and anticipate consumer behaviour next year. In the meantime, we wish you a Merry Christmas and a prosperous 2025.

Subscribe to Trajectory

The world has become a more volatile place (just ask Bashar al-Assad). For that reason, it’s vital to have an up-to-date understanding of what matters to consumers. Our monthly programme of quantitative research informs our subscription service and gives you a contemporaneous and reliable analysis of the consumer mood.

An annual subscription starts at the same price as fifty ETAs to visit the UK. You know what I’m saying.

Here are the options:

Now

An offline service that continually monitors the consumer pulse. Subscribers receive a monthly report, invitations to subscriber-only webinars and an analysis of consumer sentiment based upon our monthly fieldwork. £500 per year, per user.

Now & Next

The core, online, package. Access to monthly data, webinars, reports, articles and macro-trends. £3,200 per year per organisation (unlimited users).

Now & Next +

All of Now & Next plus offline humanity! We’re including analyst support in this package. There is also the ability to add your own questions to our monthly fieldwork with 1,500 nationally representative Britons. £7,500 per year per organisation (unlimited users).