Alright. For some.

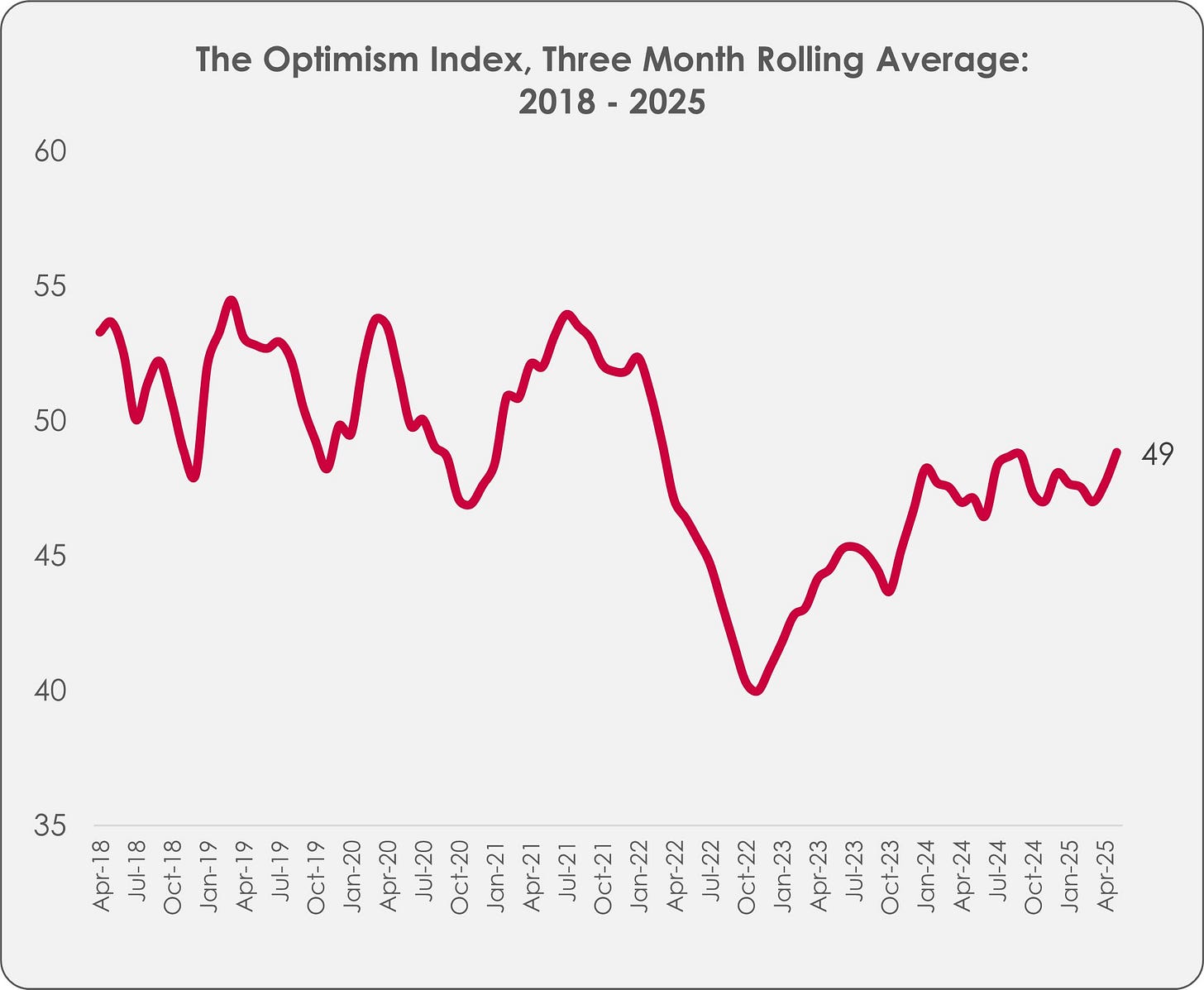

Finally. In the month of May, the Optimism Index crossed the Rubicon and entered positive territory with a score of 51. (The three month rolling average is just shy of positivity at 49.) The last time we were generally more optimistic than pessimistic was July of last year in the immediate aftermath of the General Election.

Why has the frown been turned upside down?

In part, there has been better economic news (there was an interest rate cut in early May and the growth in average earnings is greater than the rate of inflation). In addition, Britain’s trade negotiators have not been strangers to the departure lounges at Heathrow and have secured deals with India and the United States.

The warmest and driest spring in 50 years may also have engendered a sunnier disposition among Vitamin D deficient Britons.

Another factor is that the economy, while not roaring forward, is at least more stable than it has been in recent years.

Our data shows that economic and household confidence continued to grow last month; the former by nine points and the latter by four. Confidence in household finances is now net positive for the first time since last summer.

We’ve been flagging the increasing confidence of consumers for the last few months. That confidence has translated directly into spending. Last month, the British Retail Consortium reported that the value of retail sales increased by 7% in April, well above the twelve month average of 1.4%. Sales volumes are now growing at the fastest pace in four years. Barclays also recorded a rise in consumer payments, finding that spending in pubs is at a 16 month high.

Before we all head to the pub garden with a bottle of Asti Spumante and a spring in our step, it is worth reflecting on the fact that averages mask the fuller picture. The Optimism Index is being bounced higher by the tiggerish positivity of Gen Z and - in particular - Millennials. Meanwhile, Gen X and Boomers are world-weary eeyores, impatiently waiting for better days. Overall, the gap in optimism between generations, genders, regions and income bands is becoming a chasm. The Optimism Index’s return trip to positive territory is welcome news but not everyone has been invited.

As ever, the full detail of the index is available to our subscribers.

The Slow Movement

Glaciers move slowly but they change the landscape.

It’s inevitable that our attention is drawn to new and fast-moving change; we perceive a greater degree of risk in the unknown than in the familiar.

This perception has the effect of desensitising us to the extant agents of change. Advances in AI may command our attention but wearyingly familiar changes in demography will have greater consequences.

In 2023, Trajectory started writing about the impact of slow-moving (and consequently often ignored) change. This is our Slow Futures Substack.

Slow Futures serves to detonate myths. Recent despatches have found that Generation Z are, in fact, quite normal, that politics is getting more important to us, that (despite our fears over the NHS) we are no less healthy than we were and that younger people are not choosing to be single.

Slow Futures considers the ongoing impact of enduring behaviours and values. By considering slow-moving change, we provide rounded and complete foresight.

In our next webinar, we are going to draw upon some of the key learnings that Slow Futures has brought to its readership in the last two years. You can expect a lot of quite dull charts with a lot of flat data lines.

The webinar will take place on Thursday, June 26th at 09:00. (Our webinars are always on a Thursday at 9am - some things don’t change.)

The session is free and you can join us by mousing into the button below. Take your time. No need to rush.

Slow Futures is a free Trajectory resource - you can subscribe to it here.

“Heritage Creates the Future”

Imagine, for a moment, that you are the Chief Executive Officer of a European car manufacturer. At the top of your over-stuffed in-tray are tariffs in the United States, increasingly competitive cars from China and European legislation that is forcing you to make battery electric cars for consumers who don’t really want them.

What to do? Well, after you’ve swigged some Pepto-Bismol, you’d probably be looking for any degree of commercial certainty in a very uncertain world. The motor industry has never been averse to flicking through old brochures to find and revive previous successes. There are a myriad commercial examples; Fiat’s brilliant reinvention of the original 500 of 1957, BMW’s modern reimagining of the 1959 Austin Mini and VW’s modern take on the 1938 Beetle (we’ll gloss over the origins of the original car).

The CEO will be aware that the average age of a European new car buyer is 50. These mature buyers remember with affection cars from their youth. Cars such as the Ford Capri (relaunched as a BEV by Ford in 2024). Our dyspeptic CEO will likely be aware that Gen X are more nostalgic than other generations - our own data shows that only 27% of this generation consider life now to be better than it was 50 years ago.

The temptation to look backwards as a means of going forwards becomes almost overwhelming. Which brings us to Renault. Earlier this year they launched a new, battery electric, 5. This car very deliberately references the original 5 of 1972. The addressable market for that car was far bigger than Renault had envisaged; the original 5 appealed to buyers as cheap but chic mobility, a car that said something about their sophistication as a consumer. It was classless in a world of carefully managed, stratified, vehicular status.

The new 5 looks much like the old one and is even painted in the colours that populated the car parks of the 1970s; pop art yellow and maisonette bathroom suite green.

Photo: Renault UK Press Office

The new 5 has another similarity to its antecedent - price. When the original 5 was launched it came in at under the psychologically important 10,000 FFR price point. The new 5 is also priced just below a significant number, in this case £25,000. By the standards of new BEV cars, it’s cheap.

So here’s Renault’s consumer proposition – a cool, stylish, fun-to-drive, small BEV at a very reasonable price. Perhaps the first desirable and attainable battery electric car. For Generation X and above, the proposition is garnished with the warm memory of being taken to school in the original 5 with Jive Talkin and Ballroom Blitz on the radio.

In an interview with Car magazine (June 2025), Renault’s Global Marketing Director, Arnoud Belloni, noted that the average age of a European new car buyer is 50. He’s counting on Gen X motorists feeling nostalgic. So much so that Renault is doubling down on the past by reviving the 4 of 1961. Renault sold eight million examples of that model - something that will not have escaped the attention of the Chief Financial Officer.

The Renault 4 and 5 illustrate the power of nostalgia and are also livid examples of our Britain Goes Electric trend. The 5 looks like it may be the first BEV to genuinely excite the car buying public. It may be the electric car that persuades the majority.

More broadly, the need for nostalgia can best be addressed by western car manufacturers, some of whom are now a century old. By contrast, the Chinese brand BYD was only founded in 1995. It has no back catalogue to riff on.

Heritage is a point of difference. Mercedes-Benz - the first car manufacturer - recognises the value of history. They have an established Heritage business unit that fulfils a number of roles including supplying parts and restoring classics. It also delivers a valuable marketing role in showcasing celebrated past models to remind the public of the brand’s illustrious history. The importance of the past is evident in the fact that Heritage’s boss, Marcus Breitschwerdt, reports directly into the Group CEO. Mr Breitschwerdt believes that; “heritage creates the future.”

Heritage is about more than appealing to nostalgic consumers. It also has a role in reassuring nervy buyers that the quality and values that they have become used to will be present in the electric future. As Mr Breitschwerdt explains; “It’s not a break in the chain to go from internal combustion engines to electric motors. It is simply following our heritage and by using the collection [of over 1,200 cars], the museum, the archives, the events, our knowledge, we can explain that.”

Younger consumers, attuned to technology, might not need - or want - such a detailed explanation of the past. However, licence-holding, nostalgic, grey-haired consumers, dubious about some of the ‘benefits’ of modern motoring and confronted with a range of car brands that they don’t remember from their youth, may need some reassurance that their next car will be both relatable and desirable.

X factor

“Gen X - born somewhere between 1966 and 1981 - has been largely forgotten about (although even saying that has become a cliche of sorts) … What if the cool ones are actually those unbothered people that nobody talks about?”

Early in my time at the corporate coalface, I was taught the importance of reading widely, which explains how I recently came across an article entitled; “What if GenXers are actually the cool ones?” You might think that this article was in the current issue of the British Journal of Psychology. Not so. It was in Vogue magazine.

The article struck a chord as we have recently published an in-depth report on Generation X. One of the topics we looked at was the culture that Generation X lived through in their youth and how the music, films and books of the period still resonate with Millennials and Gen Z.

Vogue’s unfashionable appreciation of Generation X is welcome (and their point on coolness is entirely accurate). However, it’s still baffling that Gen X doesn’t get more attention from marketeers. My contention would be that Generation X are often Ultra-Consumers (remember, you heard the term here first). They are at their peak earning years and their income has to cover a variety of commitments. As we’ve seen, the average age of a new car buyer in Europe is 50. Our own data shows us that a third of Generation X are still paying a mortgage (the highest proportion of any generation). Gen X have to think about funding their children’s lives while making provision for their own retirement. They’ll almost certainly have bought life insurance. They are likely to have buildings and contents insurance, holiday insurance and car insurance. They are likely to have savings products and ISAs. They’ll be paying utility bills, council tax and streaming subscriptions. They’ll want to take their family on holiday. No other generation is as invested in the act of consumption as Generation X.

Our silvery Ultra-Consumers may also control spending across two households - there are eight million active Powers of Attorney in England and Wales alone. In the tax year 2023/24, the Office of the Public Guardian received 1.4 million requests for new PoAs. Many of these will be administered by Gen X. A Power of Attorney gives peace of mind to the Silent Generation and to Boomers but it imposes additional responsibilities (and consumption choices) on those in their fifties.

Gen X Ultra-Consumers could do with some help but many brands would rather talk to their children. Which seems odd.

Trajectory subscribers can access the full Generation X report on our website now.

Subscribe to Trajectory

The world has become a more volatile place (just ask Donald Tusk). For that reason, it’s vital to have an up-to-date understanding of what matters to consumers. Our monthly programme of quantitative research informs our subscription service and gives you a contemporaneous and reliable analysis of the consumer mood.

An annual subscription starts at the same price as thirty bottles of Fontanafredda DOCG Asti Spumante. You know what I’m saying. I won’t labour the point.

Here are the options:

Now

An offline service that continually monitors the consumer pulse. Subscribers receive a monthly report, invitations to subscriber-only webinars and an analysis of consumer sentiment based upon our monthly fieldwork. £500 per year, per user.

Now & Next

The core, online, package. Access to monthly data, webinars, reports, articles and macro-trends. £3,200 per year per organisation (unlimited users).

Now & Next +

All of Now & Next plus offline humanity! We’re including analyst support in this package. There is also the ability to add your own questions to our monthly fieldwork with 1,500 nationally representative Britons. £7,500 per year per organisation (unlimited users).